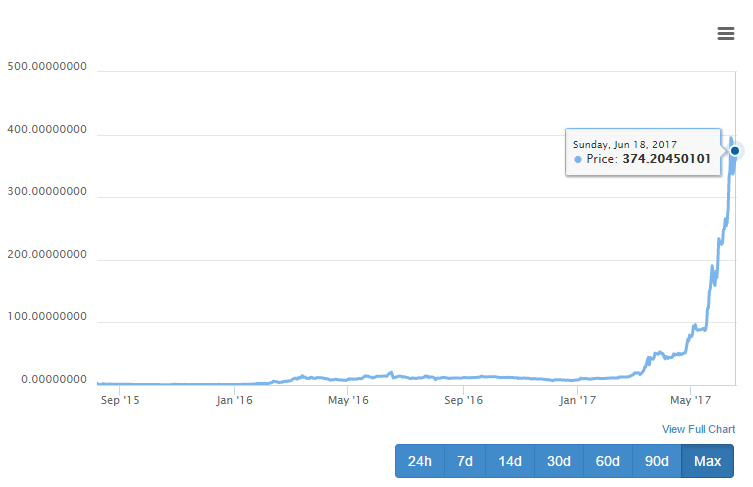

For the past few weeks all I’m hearing is Ethereum this, Ethereum that, Ethereum to the moon, Vitalik, Flippening, Lambo, hodl and so on. You get the idea. I don’t blame people who are on the ethereum spaceship to the moon. They have a reason to be excited about. Look at this beautiful graph.

Ethereum has achieved so much in so little time. It started the year with $8 and soared to $400 in less than six months. That’s a 50x jump! What on Earth happened? Is flippening going to be a reality? What’s really fueling the Ethereum price?

Of course there is no one reason why Ethereum is mooning. It is rather driven by a several factors.

1. Bitcoin politics and a potential split

Bitcoin has been gripped with too much politics for the past few years. So much so that people have started to doubt its potential and have started looking for alternatives. The debate is on how to scale the bitcoin network to handle more transactions than it can right now.

Two rival factions have emerged with completely opposing views; Bitcoin Core (the developers) and Bitcoin Unlimited (the miners) – both with different scaling proposals, BIP 148 and Segwit2x respectively.

With this cyber battle breaking out between the two camps, a possible hard fork could split the coin into two with entirely different networks. This network uncertainty has made Ethereum race ahead with technology that can do everything Bitcoin can, but faster, in higher volume, and at lower cost.

In a world where we are used to online payments being confirmed instantly, Bitcoin transactions, right now, can take anywhere between ten minutes to several hours with an average transaction cost of $1.50 – more than a daily living wage in some developing countries. It just really goes against the underlying principles of bitcoin..

It is important to note that Ethereum was never intended to be a bitcoin competitor. In fact, the two currencies have different purposes. Ethereum is actually a platform to let developers build decentralized applications (dApps) that run on a peer-to-peer network of computers.

2. Too many ICOs happening

Decentralized blockchains derive their utility from not having one ruling authority or institution, making them more secure and less corruptible. There are hundreds of startups building dApps on the public Ethereum blockchain and collecting Ethers through token sales, or Initial Coin Offerings (ICOs).

This lets startup to not only get enough funding to bootstrap their project, but also build a community around the dApp and pay a small fee to use Ethereum blockchain. Famously, Basic Attention Token, or BAT raised $35 million in just 24 seconds through their token sale.

As these ICOs and dApps get more successful, the Ethereum price will keep shooting up since they are all built upon its blockchain and require Ether as a fuel to run.

3. Superior blockchain

There is no denying that Ethereum blockchain is more superior than bitcoin’s. It’s used by the likes of Bank of America, Intel, Microsoft, and Samsung. Ethereum has quite a lot of corporate support behind it. The corporate has further solidified into one group – the Enterprise Ethereum Alliance (EEA). Ethereum supports smart contracts, which has attracted significant interest among financial institutions

The EEA was formed with the goal of standardizing the use of the Ethereum blockchain in the corporate world. It is now 116 members strong. Bitcoin failed to get this kind of support in its early days. Many argue that it still doesn’t have this backing now.

Here are some notable names in the EEA:

- Accenture

- Infosys

- AlphaPoint

- Deloitte

- JP Morgan

- Intel

- ING

- Microsoft

- Santander

Ethereum has also attracted significant support from the investors. According to CryptoCompare, more than 83% of Ether was purchased using bitcoin a year ago. As of last week, bitcoin only accounted for 32% of the buying. Fiat currencies like the U.S. dollar and the Korean won have contributed a growing portion.

Clearly, Ethereum has a tremendous amount of corporate backing and this is why it promises to be a long-term success.

4. Vladimir Putin

Some countries have shown interest in using Eth as a hedge against national currencies. Switzerland, Venezuela, South Korea and Singapore are to name a few. South Korea is doing Eth transactions on a whole new level – twice the Eth/fiat volume of Coinbase’s GDAX and Kraken combined.

Recent meeting of Ethereum’s founder, Vitalik Buterin, with the Russian President Vladimir Putin, shows Russia’s interest in the technology. It could possibly be one of the reasons behind Ethereum’s price rally.

Conclusion

While there are many factors fueling Ethereum’s price, much of the interest is based on the cryptocurrency’s ability to support smart contracts and enterprising applications.

Oh and not to forget bitcoin’s slipping dominance. If things don’t improve for bitcoin, I wouldn’t be surprised if bitcoin price lags behind Eth’s in the years to come.

So, will flippening happen? Your guess is as good as mine.